We approach a critical juncture for Silver Star Properties REIT, Inc., as we collectively determine our company’s future direction. Your decisive vote is crucial in shaping this path. We urge you to support the strategic pivot into self-storage and strongly caution against liquidation, a course of action that would irreparably harm shareholder value.

To understand our current circumstances, we must transparently address the persistent underperformance attributable to Allen Hartman’s historical pattern of deferred maintenance, negligent management practices, and disruptive tactics.

Hartman’s History of Deferred Maintenance

Under Hartman’s management, Silver Star experienced significant and avoidable capital decline. Key property infrastructures—HVAC systems, elevators, electrical systems, roofs, and safety mechanisms—were overlooked, severely undermining tenant satisfaction and property value. The deferred maintenance backlog reached a staggering $32 million, as detailed by David Strickland, our Director of Asset Management, in our podcast (https://silverstarreit.com/from-the-trenches-on-deferred-maintenance-and-proper-management/). As Dan Jones, the Sr. Executive Vice President Asset Management & Construction under Hartman, has stated, “His [Hartman’s] persistent neglect of essential building and tenant space maintenance resulted in the departure of multiple tenants annually and requiring costly rent abatements.”

Properties such as Westway I exemplify these costly oversights. HVAC systems were inadequately maintained, leading directly to tenant losses, notably at Lennar Homes, whose departure significantly impaired property marketability. Similarly, Gulf Plaza experienced critical infrastructure failures, including prolonged elevator outages and air conditioning malfunctions, which pushed anchor tenants toward relocation and dramatically diminished property valuation.

Financial and Reputational Impact

Hartman’s financial mismanagement has further compounded these issues. His decision-making, including excessive risk-taking with variable-rate electricity contracts, resulted in nearly $7 million in additional costs during Winter Storm Uri. These expenses were improperly billed to tenants, significantly damaging tenant relations and retention.

Moreover, Hartman’s misallocation of company funds and prioritization of distributions over essential maintenance precipitated vendor payment delays and operational disruptions. This mismanagement culminated in Silver Star defaulting with its primary lender and facing severe cash flow restrictions (a “cash trap”), which critically impaired our operational capabilities.

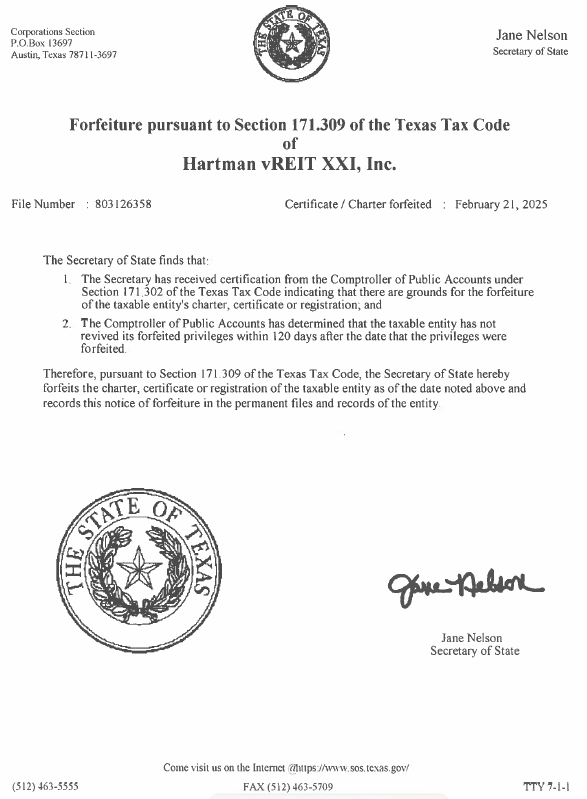

Despite Hartman’s boasts about effectively running his new company, Hartman XXI, recent filings indicate that its charter in the State of Texas has been forfeited. This disturbing development underscores Hartman’s ongoing reckless disregard for corporate governance and regulatory compliance.

His carelessness isn’t new—it mirrors his previous mismanagement at Silver Star, resulting in substantial financial and reputational damage. Allowing Hartman’s further influence jeopardizes our investment and our company’s future stability.

Hartman’s Disruptive Tactics and Litigation

Regrettably, Hartman’s departure from the CEO position did not end his detrimental influence. His continued use of frivolous litigation and filings of lis pendens without legal justification obstructed crucial refinancing efforts and property sales, pushing Silver Star into an avoidable Chapter 11 Bankruptcy. The Maryland court explicitly recognized Hartman’s actions as abusive tactics aimed at extracting unwarranted financial concessions from the company, significantly increasing operational and legal costs.

His unethical maneuvering included attempting to strong-arm the company into transferring valuable properties directly to him, threatening costly proxy battles, and significantly hampering our recovery efforts.

The Importance of Strategic Pivot vs. Liquidation

Faced with these challenges, your current Board, elected by an overwhelming majority in 2024 and explicitly excluding Hartman, has diligently assessed options to maximize shareholder value. We affirm that the best path forward is to pivot strategically into the self-storage industry.

Liquidation at this point, with properties burdened by extensive deferred maintenance and lender-imposed constraints, would trigger forced fire sales at significantly undervalued prices. Such an outcome would not only diminish your investment returns but would also irreparably harm our long-term prospects.

In contrast, the pivot to self-storage is a strategic, forward-thinking initiative designed to harness growing market demand. This pivot promises stability, improved operational efficiency, improved cash flow characteristics and enhanced value creation for shareholders. Our meticulous planning and management improvements have positioned us to seize this opportunity effectively.

Leadership and Integrity

Our commitment is clear: restore shareholder value, operate transparently, re-establish dividends, provide liquidity and manage strategically. Gerald Haddock’s leadership has steered the company away from historical mismanagement toward a focused, profitable future. The current leadership team prioritizes immediate maintenance responses, tenant satisfaction, and operational excellence, fostering tenant retention and stabilizing our financial performance.

Reject Misinformation

Hartman’s tactics have included disseminating misleading information intended to divide shareholders and undermine confidence in your duly elected leadership. It is vital that we remain united, focused, and resilient against such distractions. The integrity and transparency of your Board remain uncompromised, and our collective aim is to protect and enhance your investments.

We stand prepared to continue the rigorous fight against Hartman’s baseless claims, frivolous litigation, and disruptive behaviors, ensuring Silver Star emerges stronger.

Your Vote Matters

In closing, let us be explicitly clear: we have no interest in interfering with Allen Hartman’s reckless mismanagement of his own resources or the finances of his new venture. However, we remain fiercely committed to ensuring he never again jeopardizes your investments. Hartman’s history speaks volumes—he has demonstrated a persistent disregard for sound business practices, resulting in profound financial damage and operational chaos at Silver Star.

We will fight aggressively in the upcoming proxy to secure your best interests. We will relentlessly pursue justice in the courts of Harris County to reclaim the significant losses you endured due to Hartman’s malfeasance. Protecting your investment is our paramount concern, and we stand resolute in our determination to keep your assets safe from Hartman’s harmful and self-serving agenda.

Shareholders’ past votes have clearly demonstrated trust in our direction. We respectfully request your continued support at this pivotal moment. Vote FOR the strategic pivot to self-storage, thereby securing your investment’s long-term value and fortifying our collective future.

Voting instructions have been provided via email and postal mail. For convenience, you can also visit our proxy website at https://web.viewproxy.com/silverstarreit/2025.

Together, we can move forward decisively, strengthening our company and safeguarding your investment.

Thank you for your continued confidence and support.

Warm regards,

Investor Relations

877-734-8876

ADDITIONAL INFORMATION AND WHERE TO FIND IT

The Company has filed with the SEC a definitive proxy statement on Schedule 14A on May 29, 2025, containing relevant documents with respect to its solicitation of proxies for the Company’s 2025 Annual Meeting. INVESTORS AND SECURITY HOLDERS ARE URGED TO READ THE DEFINITIVE PROXY STATEMENT (INCLUDING ANY AMENDMENTS OR SUPPLEMENTS THERETO) FILED BY THE COMPANY AND ANY OTHER RELEVANT DOCUMENTS FILED WITH THE SEC CAREFULLY AND IN THEIR ENTIRETY BECAUSE THEY CONTAIN OR WILL CONTAIN IMPORTANT INFORMATION ABOUT ANY SOLICITATION. Investors and security holders may obtain copies of these documents and other documents filed with the SEC by the Company free of charge through the website maintained by the SEC at www.sec.gov. Copies of the documents filed by the Company are also available free of charge by accessing the Company website at www.silverstarreit.com.

Participants in the Solicitation

Silver Star and its directors and executive officers may be deemed to be participants in the solicitation of proxies with respect to the 2025 Annual Meeting. Information regarding Silver Star’s directors and executive officers is contained in the definitive proxy statement. As of May 29, 2025, the Silver Star Executive Committee, current directors, other than Allen Hartman, and executive officers beneficially owned approximately 1,172,436 shares, or 1.74%, of Silver Star common stock. Allen Hartman beneficially owned approximately 5,006,412 shares, or 7.43%, of Silver Star common stock. Additional information regarding the interests of such participants is included in the definitive proxy statement and is available free of charge at the SEC’s website at www.sec.gov.

###

Forward-Looking Statements: This message contains a number of forward-looking statements. Because such statements include a number of risks, uncertainties, and contingencies, actual results may differ materially from those expressed or implied by such forward-looking statements, and investors should not place undue reliance on any such statements. Forward-looking statements can often be identified by words such as “continues,” “can,” expect,” “intend,” “will,” “anticipate,” “estimate,” “may,” “plan,” “believe” and similar expressions, and variations or negatives of these words. These forward-looking statements include, but are not limited to, statements regarding the Company’s search for a new auditor and its hope that a new auditor can be engaged in the near future and that its annual report on Form 10-K can be completed and publicly filed; the continuation of the examination of the current operations of Southern Star; the Company’s intent to consider various alternatives, including the possible sale of Southern Star, the sale of specific assets within individual DSTs and dissolution of the respective trusts, and/or the outsourcing of various aspects of Southern Star’s operations; the Company’s plan to update investors with respect to the status of Southern Star as appropriate; the Company’s expectations and beliefs regarding the Hartman litigation; the timing and ultimate resolution of the various litigation, fight for corporate control and other matters involving Hartman; the continued execution of the Company’s strategy of pivoting into the self-storage space; the Company’s continual evaluation of its legacy assets in order to maximize shareholder value; the Company’s policy to not dispose of any asset for less than its maximum determinable value and to maximize earnings and value; the implications to the Company of the assignment of an OTC trading symbol for its common stock; whether the Company may be subject to certain FINRA rules; any actions the Company may need to take to comply with any FINRA rules; the Company’s continual evaluation of various options to provide greater shareholder liquidity, including its intention to seek listing of its common stock on a securities exchange or admission to over-the-counter trading, a public offering, a listing of the common stock on an exchange or admission to OTC trading without a public offering, and merger and/or acquisition opportunities; the Company’s belief that further legal action could ensue to unwind the issuance of common shares under the Rights Plan if Hartman prevails in his efforts to set aside or invalidate the Rights Plan or to cause the dilutive issuance of additional common shares to Hartman, as well as any further action Hartman may take to prevent other Company shareholders from receiving benefits under the Rights Plan. None of the foregoing are guarantees or assurances of future outcomes or results and all are subject to numerous risks, uncertainties and assumptions that could cause actual results to differ materially from those expressed in any forward-looking statement. A number of important factors could cause actual results to differ materially from the forward-looking statements contained in this material. Forward-looking statements in this press release speak only as of the date on which such statements were made, and the Company undertakes no obligation to update any such statements that may become untrue because of subsequent events. Such forward-looking statements are subject to the safe harbor protection for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995.